Breaking Down the Moats of Medical Tech Giants: Intuitive Surgical, Zimmer Biomet, Stryker, and Smith & Nephew

Uncover how cutting-edge technology, market strategies, and innovation create competitive advantages in the high-stakes medical device industry.

Imagine a world where robots perform surgeries with unparalleled precision, orthopedic implants redefine mobility, and advanced wound care accelerates healing. Welcome to the dynamic universe of medical technology, where giants like Intuitive Surgical, Zimmer Biomet, Stryker, and Smith & Nephew are shaping the future of healthcare. These companies are locked in an intense race to outpace one another through innovation, market strategies, and competitive moats. But what gives them their edge? Let’s explore their strengths, weaknesses, and the factors driving this industry’s evolution.

The Anatomy of Competitive Moats

Moats—competitive advantages that shield a company from rivals—are critical in the high-tech medical field. These moats are built on technological innovation, regulatory expertise, and customer loyalty. Let’s dissect the unique strengths of these four market leaders.

1. Intuitive Surgical: The Pioneer of Robotic Surgery

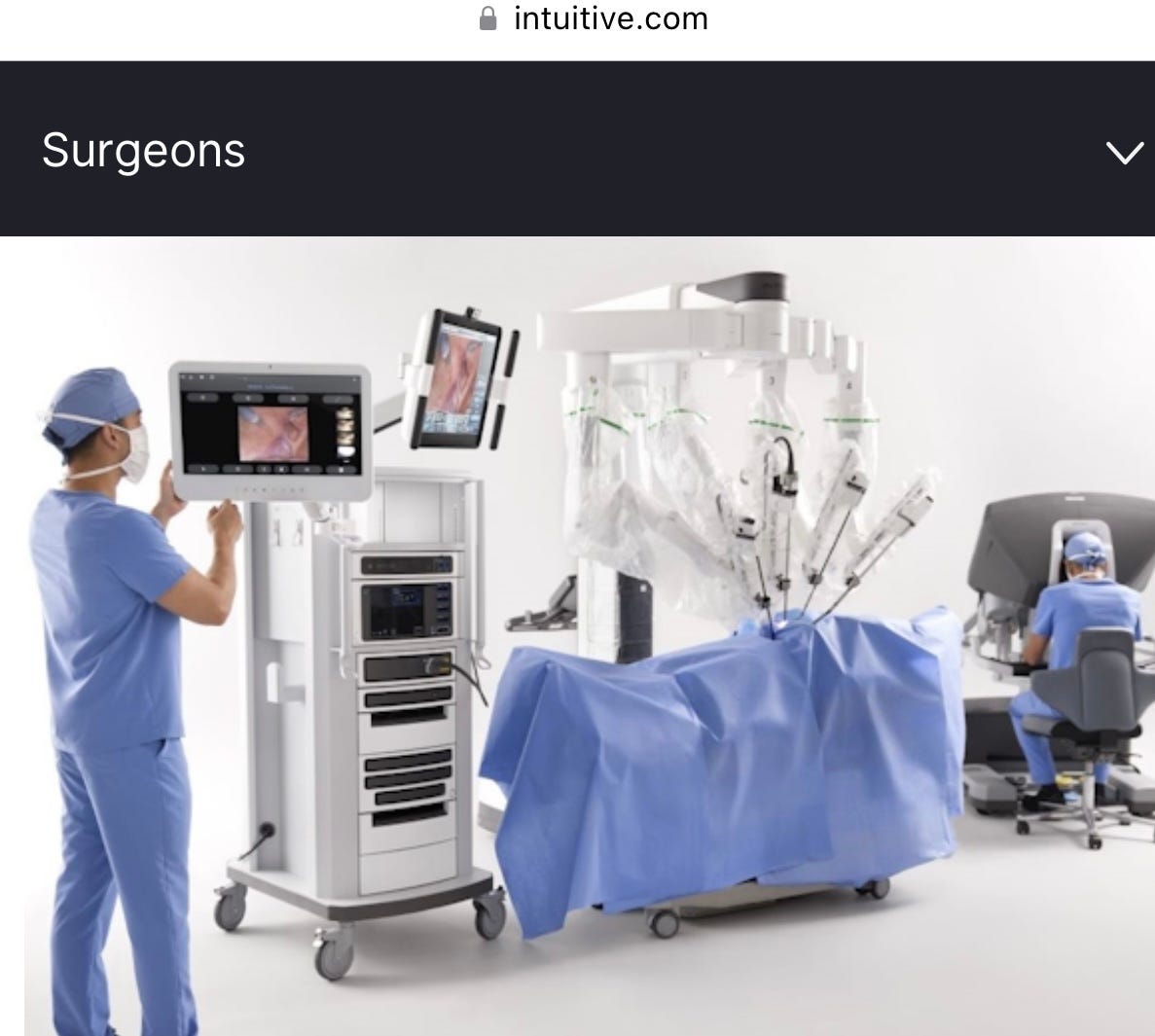

Intuitive Surgical (ISRG) is synonymous with robotic surgery, thanks to its groundbreaking da Vinci Surgical System. By 2023, over 7,500 da Vinci systems were installed globally, capturing a massive 70% market share in robotic-assisted procedures.

What makes Intuitive Surgical nearly untouchable?

• Technological Leadership: With 2,600+ patents, Intuitive Surgical has fortified its position as an innovation powerhouse. These patents act like a fortress, making it nearly impossible for competitors to replicate its technology.

• High Switching Costs: Hospitals have invested heavily in Intuitive’s ecosystem, from purchasing the systems to training 70,000+ surgeons worldwide. These sunk costs make switching to a competitor’s platform economically and operationally daunting.

• Recurring Revenue Model: The real genius lies in Intuitive’s revenue mix. 78% of its $6.9 billion revenue comes from services and accessories—stable, predictable income streams that insulate the company from economic shocks.

Despite competition from Stryker’s Mako and Zimmer Biomet’s Rosa, Intuitive’s head start, robust IP portfolio, and established customer base keep it ahead in the robotics space.

2. Zimmer Biomet: The Orthopedic Titan

When it comes to orthopedics, Zimmer Biomet (ZBH) dominates. With a 36% global market share in knee implants and 23% in hip implants, Zimmer is a trusted name in joint replacement.

What gives Zimmer Biomet its edge?

• Regulatory Expertise: Developing medical implants is a rigorous process, requiring 5–7 years of FDA approval. This timeline creates a natural moat, discouraging new entrants from entering the market.

• Specialized Distribution Network: Zimmer’s partnerships with 3,500+ healthcare providers ensure it remains a preferred choice in hospitals worldwide.

• Brand Trust: Surgeons often prefer Zimmer products due to their reliability and customization options, creating high switching costs.

However, Zimmer Biomet faces challenges. Its Rosa robotic system is struggling to gain traction, growing at only 6% in 2023, compared to double-digit growth from competitors’ robotics platforms.

3. Stryker: The Innovator with a Diversified Portfolio

Stryker (SYK) thrives on diversity. With $20.5 billion in revenue split between MedSurg and Neurotechnology (58%) and Orthopedics and Spine (42%), it has minimized sector-specific risks.

Stryker’s competitive advantages include:

• Mako Robotic System: A rising star in robotic joint replacement, Mako has 1,600+ systems installed globally and a 15% market share in this segment.

• Economies of Scale: By bundling robotics with implants, Stryker creates a seamless ecosystem for hospitals. This integration fosters customer loyalty and increases efficiency.

• First-Mover Advantage: Stryker leads in neurovascular devices and uses 3D printing for implants, boosting surgical precision and patient outcomes.

While Stryker’s Mako system is gaining momentum, it still trails Intuitive Surgical in overall robotic surgery market share. But its broad portfolio provides resilience and room to innovate.

4. Smith & Nephew: The Niche Specialist

While Smith & Nephew (SNN) lacks the scale of its competitors, it shines in advanced wound care and sports medicine. These segments accounted for 29% of its revenue in 2023, with a 40% share in the global advanced wound management market.

Smith & Nephew’s moat lies in:

• Focus on Underserved Markets: Unlike larger rivals, Smith & Nephew targets niches with limited competition, allowing it to maintain high profit margins.

• Regional Dominance: The company holds significant market share in Europe, leveraging regional expertise to offset its smaller scale.

However, its limited presence in the U.S. and slower adoption of its Navio robotic system hinder its ability to compete on a larger stage.

The Battlegrounds: Robotics, Orthopedics, and Wound Care

The medical device industry is evolving rapidly, with new technologies and market demands shaping competitive dynamics. Here’s where the major players clash.

1. Robotic Surgery: A High-Stakes Arena

Robotics is the crown jewel of medical technology. Intuitive Surgical dominates with its comprehensive platform, but competitors like Stryker and Zimmer Biomet are catching up.

• Intuitive’s Advantage: Its extensive network of trained surgeons creates a formidable barrier. In 2023, robotic-assisted procedures grew by 18% year-over-year, far outpacing competitors.

• The Rising Challengers: While Stryker’s Mako focuses on joint replacements, Zimmer’s Rosa is still in the early stages of adoption. New entrants like Medtronic’s Hugo and J&J’s Ottava add fresh pressure to incumbents.

2. Orthopedics: The Heart of Zimmer and Stryker’s Rivalry

Zimmer Biomet and Stryker dominate orthopedics, but their approaches differ.

• Zimmer’s Traditional Strengths: Its expertise in implants and surgeon relationships ensures it remains a market leader.

• Stryker’s Technological Edge: By integrating robotics with implants, Stryker offers a compelling value proposition that improves surgical outcomes.

3. Wound Care: Smith & Nephew’s Domain

Smith & Nephew leads in advanced wound care, but faces competition from low-cost entrants like Medline. Its stronghold in Europe provides stability, but global expansion remains a challenge.

Barriers to Entry and Challenges Ahead

The industry’s barriers to entry are significant, but not insurmountable:

• Technological Innovation: Intuitive Surgical’s patent moat is a high hurdle, but advancements in AI and imaging could democratize robotics.

• Regulatory Hurdles: The lengthy FDA approval process protects incumbents but could evolve with newer, faster regulatory pathways.

• Surgeon Training: Intuitive’s investment in surgeon training creates loyalty, but competitors are starting to ramp up their programs.

Emerging markets in Asia and the rise of tech-savvy entrants like Medtronic will test these companies’ resilience in the coming decade.

Conclusion

Each company—Intuitive Surgical, Zimmer Biomet, Stryker, and Smith & Nephew—has carved out a unique space in the competitive landscape of medical technology. Intuitive Surgical leads the robotics charge, leveraging innovation and customer loyalty. Zimmer Biomet reigns supreme in traditional orthopedics, while Stryker’s diversified portfolio positions it as a formidable all-rounder. Meanwhile, Smith & Nephew excels in niches but faces scalability challenges.

As robotics, AI, and emerging markets reshape healthcare, the real question isn’t who leads today, but who will adapt fastest tomorrow. Will the industry’s current leaders retain their moats, or will newcomers disrupt the balance? Only time will tell—but the stakes couldn’t be higher.

P.S.: PRICE INCREASES TODAY. If this article resonated with you, I’d love your feedback. Did you enjoy the detailed breakdown of these medical technology giants and their competitive moats? Let me know by hitting the like button or sharing your thoughts. This helps me craft even better content that you’ll find valuable. I can also create more in-depth articles like this or even launch a dedicated newsletter focusing exclusively on these cutting-edge industries and strategies. Alternatively, I can fine-tune the approach of my current newsletter based on what you find most engaging.

Here’s the best part: By subscribing now, you lock in the lowest price this newsletter will ever have. The current annual subscription is $169—a steal compared to the final price of $500 per year. Not only are you saving 65%, but you’re also securing this rate forever, while those who subscribe later will always pay more. Think of it as less than the cost of a coffee per day for exclusive insights that could transform your investment knowledge and decision-making.

Act now. Prices increase at 11:59 PM California time tonight, and only a few spots remain at this discounted rate. Plus, your payment is managed securely through Stripe, the trusted platform handling billions of dollars in transactions worldwide. Take advantage of this incredible deal to ensure you never miss a chance to gain an edge in your understanding of complex markets.

Invest in your future—starting today.