Inside Lockheed Martin

With a backlog bigger than some countries’ entire economies, Lockheed Martin has contracts locked in for years—giving it a fortress-like revenue stream.

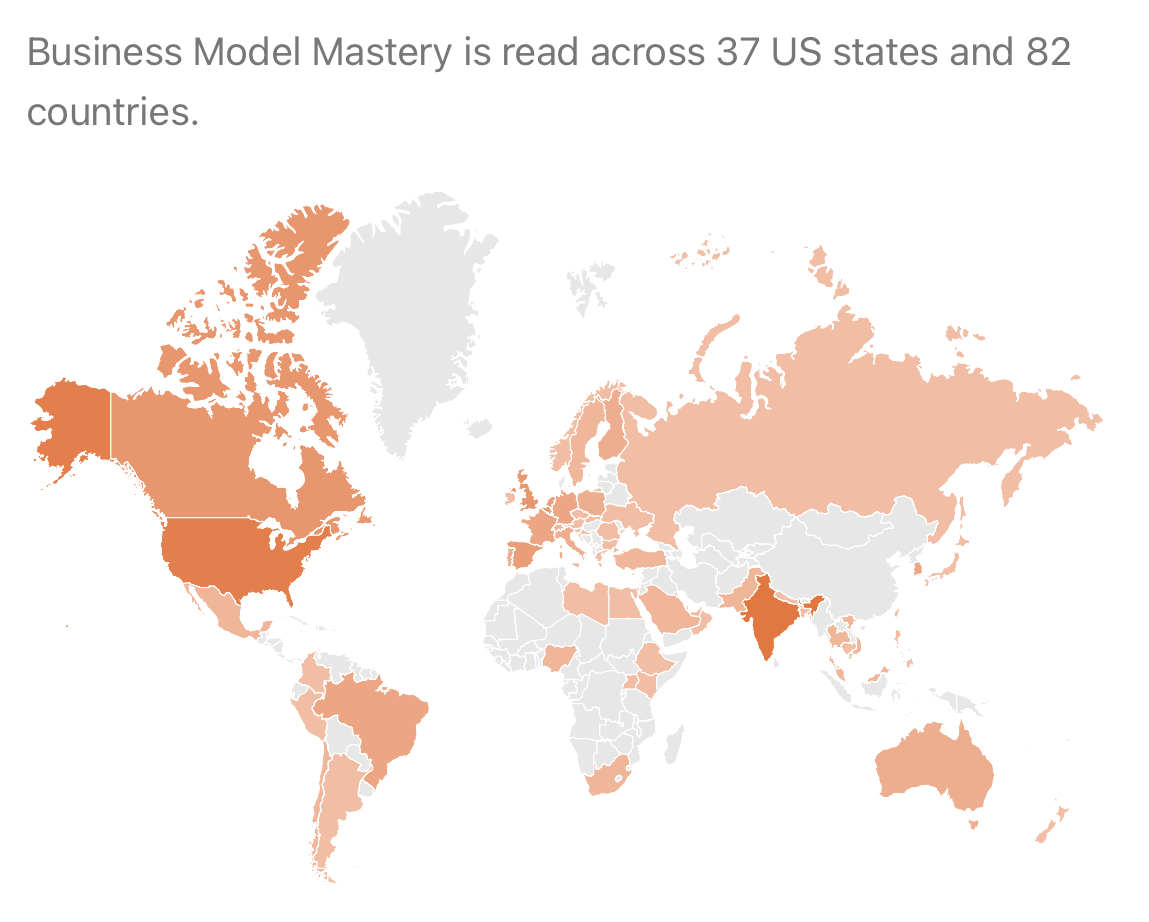

Trusted by 1,850+ private investors worldwide, Business Model Mastery is your daily ritual for building an edge over the market.

Each issue breaks down how great businesses truly operate—and what sets them apart by analyzing one company a day, helping you steadily build your own mental database of business models.

I handle the heavy lifting—digging into reports, filings, and key data—so you can focus on recognizing superior business models, comparing opportunities, and outthinking the market.

With 85+ business models analyzed so far, you have a growing library of insights at your fingertips. Each analysis brings you closer to sharpening your edge and building the conviction to invest with clarity and confidence.

If you haven’t yet, lock in the lowest price before rates rise.

Let’s begin.

I want to show you a side of the defense industry that most market watchers fail to see. People know Lockheed Martin as the creator of famous fighter jets and missile defense systems, but few grasp the hidden layers that shield its dominance. This isn’t just about selling military aircraft. It’s about owning the deepest pipelines of innovation, controlling vital parts of the global supply chain, and cultivating relationships that shape national defense strategies. I’ve spent years studying how defense giants operate, and every time I think I’ve seen it all, Lockheed Martin surprises me with another breakthrough, another secured contract, another quiet move that solidifies its power. By the end of our journey, you’ll see why this company’s position feels almost impenetrable—and how understanding its inner workings can sharpen your own investment instincts.

From the start, Lockheed Martin made its name through specialized projects that other firms could only dream of tackling. The F-35 Lightning II, for instance, might sound like just another advanced jet, but it alone contributes 26% of Lockheed Martin’s total revenue, with overall Aeronautics bringing in around $27.8 billion this year. Everywhere I look, I see the same pattern: vital programs that cement Lockheed’s presence in the U.S. Department of Defense budget. The DoD accounts for 65% of the company’s entire revenue, and that’s not counting additional payments from NASA and other agencies. When I discovered that 73% of Lockheed Martin’s total revenue comes straight from the U.S. Government, I started asking a question: Why is a single firm entrusted with so many high-stakes projects?

The answer is both simple and profound: Lockheed Martin has earned a reputation for solving ultra-complex problems—building jets that avoid radar detection, missiles that intercept threats in seconds, satellites that monitor the world from orbit. In today’s world, that expertise is priceless. While roughly 27% of the company’s revenue does come from foreign military sales, the bedrock is the trust Lockheed has built with Washington. Few companies can match such a privileged position, and in many ways, Lockheed’s revenue streams are bolstered by its role as a go-to partner for advanced national defense systems.

I’ve watched how the company divides its operations into four segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. Yet I learned that these segments aren’t just convenient bookkeeping categories; they reflect strategic focus areas with distinct customer demands. Aeronautics alone captures 40% of total revenue, spearheaded by high-profile aircraft programs like the F-35, F-16, and C-130. Meanwhile, Missiles and Fire Control (MFC) recently enjoyed the fastest year-over-year growth at 11%, fueled by surging demand for solutions like THAAD and HIMARS. Some commentators told me that you can gauge global tensions by looking at MFC’s order backlog. In the last year, the backlog stood at $159 billion across the entire company, up 5% from before, as governments raced to lock in next-generation missile defense capabilities.

Not all segments move at the same pace, though. Aeronautics—a core focus—remained fairly steady, hovering at flat year-over-year growth. The F-35’s production tempo stabilized for the moment, and that explained why the revenue uptick wasn’t more dramatic in that division. By contrast, the Missiles and Fire Control segment soared, supporting an overall revenue of about $69.3 billion this year, a 3.2% jump from last year. I see that as a sign of Lockheed Martin’s adaptability. Whenever defense priorities shift, there’s a Lockheed offering ready to fill the gap.

Profitability often reveals how efficient a company truly is, and here Lockheed Martin’s margins paint a telling story. While the gross margin dipped slightly from 15.2% down to 14.7%, the operating margin has managed to stay near 10.3%. In part, that’s thanks to MFC, which boasts operating margins of 12.8%, higher than the Aeronautics business at around 10.4%. Supply chain pressures have squeezed margins in certain areas, but Lockheed seems more than capable of offsetting challenges through its balance of high-volume fighter jet production and premium-priced precision weapons. I’ve seen many aerospace firms struggle with profit swings due to contract unpredictability, but Lockheed’s diversity of programs keeps it relatively stable. That stability is further reflected in the net income margin, which holds at 9.1%, though that’s slightly lower than before due to rising interest expenses.

This leads me to what I consider the heart of Lockheed’s durability: its tight grip on key customers and suppliers. Just three main customers—the U.S. Department of Defense, NASA, and foreign military buyers—represent 80% of its total revenue. For many businesses, such concentration might sound risky. Yet in the defense world, forging a deep relationship with the Pentagon can provide decades of dependable contracts. When I looked into how reliant Lockheed is on specialized materials, I found that certain components—like advanced microelectronics or rare earth minerals—may come from single-source suppliers, magnifying potential supply chain vulnerabilities. Still, the steady backlog and the nature of government contracting help insulate Lockheed from sudden shocks. In the defense sector, risk often translates into bigger spending on future tech, which benefits Lockheed in the long run.

The real gem in Lockheed’s arsenal is its massive backlog, valued at $159 billion and rising. This backlog is not just a number; it’s a multi-year pipeline of guaranteed projects, each tied to government allocations that rarely get canceled outright. Whenever the political environment calls for stronger missile defense, Lockheed’s MFC business collects more contracts. When tensions escalate globally, F-35s find buyers among allied nations seeking top-tier air power. The cycle perpetuates itself, with Lockheed at the center.

I like to measure a company’s operational health through key performance indicators that go beyond just the top line. For Lockheed, I keep my eyes on three big metrics: backlog, free cash flow, and book-to-bill ratio. Its free cash flow of $7.2 billion remains stable, affirming that it can self-finance new initiatives and sustain dividends that now hover around 2.7%. Meanwhile, the book-to-bill ratio at 1.12 sends an unmistakable signal: new orders exceed current sales, fueling future growth. That alone makes me pay close attention when analyzing Lockheed’s quarterly updates, because a book-to-bill consistently above 1.0 suggests demand for its products keeps accelerating.

For a deeper insight, I ask myself: Which programs offer the highest margins over time? Hypersonic weapons stand out. They carry roughly 20% gross margin on average, outperforming many legacy platforms, and are expected to hit a total market value of $50 billion by 2030 with a brisk 15% compound annual growth rate. That’s why you see Lockheed pouring over $2.5 billion into R&D each year. It’s not only about defending the present; it’s about securing the future. If you track industry chatter, you’ll see talk about developing the Next Generation Interceptor for ballistic missile defense, advanced AI-driven systems, and the Orion spacecraft for NASA. Each project ties Lockheed closer to national security roadmaps, further entrenching it as the top choice for large-scale defense commitments.

Of course, no fortress is truly without weaknesses. Lockheed faces competitive heat from Northrop Grumman, Boeing, RTX Corporation (formerly Raytheon), and General Dynamics—each one fighting to dominate niches like stealth bombers, submarines, or cutting-edge radar systems. On the surface, it might seem these giants merely divide the spoils, but I’ve seen them push ever deeper into advanced tech, from integrated missile systems to next-gen drones and hypersonics. Northrop, for instance, introduced the B-21 Raider stealth bomber and is advancing its own hypersonic programs. Boeing has its F/A-18 jets and now invests aggressively in futuristic space technology. Competition is good for the Pentagon budget, but it can compress margins if Lockheed loses ground in strategic areas. Right now, Lockheed holds about 70% share in missile interceptors like PAC-3 and THAAD, while the F-35 claims a staggering 85% share of fifth-generation fighter jets globally. But as new technologies emerge, these figures might come under pressure.

I’ve questioned whether these advantages are sustainable. In many ways, they are. The high cost and complexity of modern defense systems serve as natural barriers to entry. Lockheed spends over $2.5 billion each year on R&D,creating proprietary technologies that smaller contractors can’t easily replicate. Government protections, including strict export controls, limit how foreign defense companies can challenge U.S. firms on American soil. Even so, Boeing’s upcoming B-21 stealth platform could siphon potential funding streams from the F-35, and Northrop’s advanced missile defense research could nibble at Lockheed’s share in that market. These threats, however, remain more of a slow erosion than an immediate landslide. Lockheed’s scale and existing client relationships grant it a formidable shield. It’s the largest defense contractor in the United States, allowing it to negotiate favorable terms and access budgets that keep smaller firms at bay.

To gauge the company’s financial stability under these pressures, I look at metrics like debt-to-equity (1.4x) and net income performance ($6.3 billion this year). The debt isn’t trivial, but for a company generating steady free cash flow, it’s manageable. Even if interest expenses tick upward, Lockheed’s multi-year contracts provide predictable revenues, and I see no immediate sign that the Pentagon will trim the largest programs—like the F-35—to the bone. Meanwhile, the possibility of higher international defense spending could further cushion any dips in U.S. allocations.

The big question: What’s next? Industry forecasts show that Lockheed’s revenue might climb to $71 billion in 2025, driven largely by a push into new missile systems and possibly more F-35 orders from allied nations. Hypersonics stand out as a key growth driver, with a projected annual increase of 15% until 2030, reinforcing the notion that Lockheed is placing the right bets on advanced technologies. Beyond that, an expansion in AI-driven defense systems is coming. We’re seeing glimpses of how the Pentagon wants to integrate machine learning into threat detection, drone swarms, and even pilot-assist features in next-gen fighter jets. Companies like Lockheed, which already have a foothold in these areas, could see these innovations become central to their future revenue.

I don’t mean to suggest everything is guaranteed. Defense budgets can shrink if public policy shifts toward domestic priorities. If the U.S. Government decides to cut spending on certain programs, or if the political climate changes drastically, Lockheed’s bottom line might feel the sting. Supply chain disruptions in advanced electronics—think microchips or specialized materials—can also cause headaches. Then there’s the possibility of competition eating into specific segments like hypersonics or advanced satellites. The B-21 Raider from Northrop alone could attract considerable funding that might have gone to Lockheed’s next-generation aircraft. Yet every time I weigh these risks, I come back to the same conclusion: the sheer scale of Lockheed’s involvement across aeronautics, missiles, space, and more creates a network of revenue streams that’s exceptionally tough to topple.

At the end of the day, Lockheed Martin’s durability isn’t just about numbers. It’s about an ecosystem—one that spans governments, advanced suppliers, and decades of trust built through consistent performance. You don’t become the Pentagon’s largest contractor overnight. You earn it through reliable delivery of complex systems, year after year, under the relentless scrutiny of global politics. That track record translates into stable cash flow, high-value projects, and a seat at the table whenever the U.S. Government or its allies plan their next critical defense initiatives.

For investors, the takeaway is clear: any company that wields this much influence in national security has a unique edge. But with that edge comes the need for constant vigilance. I’ve learned that these large contractors enjoy the spotlight only as long as they keep innovating and addressing emerging threats more effectively than anyone else.Lockheed Martin’s focus on hypersonic weapons, advanced fighter jets, AI-driven warfare, and next-gen satellites suggests it’s fully aware of that obligation.

When I think about the long-term horizon, I see Lockheed Martin retaining a powerful moat, anchored by high R&D spending, vast economies of scale, and a backlog that keeps climbing. At the same time, I watch how competitors seek to catch up. Every new project like the Next Generation Interceptor or the Orion spacecraft adds to Lockheed’s credibility—and, crucially, to its revenue. The closer I look, the more I realize this is not just an arms race but a race for the future of technology itself. And Lockheed, for now, holds a strong position at the forefront.

If you walk away with one thing, let it be this: understanding Lockheed Martin is understanding how the defense world really works. You see how a single company can dominate crucial corners of aerospace, missiles, cyber, and beyond, all underpinned by relationships few rivals can replicate. I believe that knowledge is something that compounds over time, giving us a sharper lens for every investment decision, both within and outside the defense sector. That’s the real benefit of studying these hidden structures—recognizing the patterns that explain why some businesses stand so tall and stay there for decades.

Let’s keep sharpening your edge, one business model at a time.

See you tomorrow.

✋🏼 P.S: Before you go, I have a few important messages to share with you. 👇🏻

Getting value from Business Model Mastery? Hit LIKE (❤️)—it’s how you shape what comes next.

Every issue breaks down how great businesses really work—exposing hidden revenue streams, competitive advantages, and the factors that keep them ahead. I do the deep research so you can spot opportunities before the market catches on.

But here’s the deal: Liking this isn’t just appreciation—it’s a signal. It tells me what’s resonating, what to double down on, and which insights sharpen your edge the most.

If this helped you see smarter, think sharper, and invest better, hit LIKE now—so I know to bring you more of it.

💡 Must-Reads You’ll Love

In Case You Missed Them: Our Most-Loved Must-Reads to Sharpen Your Edge 👇🏻

✍️ 🏆 Share Your Insight and Win a Special Prize

I’d love to hear from you. What’s the most valuable insight you’ve gained from this article—or from any of my past writings? More importantly, how has it shifted your perspective? Maybe it’s changed the way you approach investments or helped you spot hidden opportunities in a niche industry you hadn’t appreciated before.

Your feedback matters—it helps me refine the content and deliver even more value. You can share your thoughts with me directly via private message or post them as a comment on the article. To make it even more exciting, the most thoughtful and detailed response will win a special prize. I look forward to hearing your insights.

⏰ Your Limited-Time Offer

Right now, you can lock in a forever rate of $297/year—a permanent 40%+ discount from the regular $500/year. With only 10 spots originally available, just a few remain. Once they’re gone, the price rises—regardless of the deadline on Sunday, March 23rd at 11:59 PM (California time). This isn’t just about saving money—it’s about securing a lasting edge. For less than a coffee a day, you’ll gain daily insights that break down how great businesses truly operate, analyzing one company at a time to help you steadily build a mental database of business models. I handle the heavy lifting—digging into reports, filings, and key data—so you can focus on recognizing superior business models, comparing opportunities, and outthinking the market.

And…

Payments are processed securely through Stripe, and your card won’t be charged until the subscription reaches $500/year—letting you lock in today’s discounted rate risk-free. While all past content is still free, it will soon become exclusive to paying subscribers. Subscribing now secures uninterrupted access at the current rate forever. This isn’t just a financial decision—it’s an investment in sharpening your thinking, understanding what sets winning businesses apart, and building a competitive edge that keeps you ahead of the market. Lock in your forever price today and start mastering business models to outthink—and outperform—other investors.

📣 Share What You Have Learned—And Unlock Exclusive Rewards

If these analyses resonate with you, don’t keep them to yourself—share them with a fellow investor. By doing so, you’re not just helping someone else gain clarity; you’re reinforcing your own understanding through meaningful discussion. The best investors grow together, exchanging insights and pushing each other to spot opportunities others often overlook.

Now, you can turn that sharing into something even more valuable. Join the Business Model Mastery Referral Program and unlock exclusive, advanced content designed to elevate your investing strategy. Here’s what you can access by referring friends:

• The Beauty Industry Report (5 referrals)– A deep dive into one of the safest and most profitable sectors for private investors.

• Discover Your Unfair Advantage (10 referrals)– Strategies to leverage the unique edge private investors have over large institutions.

• Spotting Network Effects Early (25 referrals)– Learn how to identify one of the most powerful competitive advantages before others even see it.

Plus, the first five participants to hit 25 referrals will receive my personal Company Analysis Checklist—a private tool crafted to save you time, reduce risk, and highlight the most profitable investment opportunities.

Start sharing today, deepen your expertise, and take your investing strategy to the next level. You can find full information here 👇🏻

🚫 Check Your Spam Folder

Sometimes, emails with images or links end up in Spam or Promotions folders. If you don’t see the latest breakdown, please check there. Mark it as important, so you never miss a valuable insight. A single overlooked email could be the one that saves you from a big mistake or reveals an unexpected winner.

Disclaimer: This content is informational, not financial or professional advice. Investing involves potential loss, and by using this material, you agree to accept all risks and waive class-action rights. Full disclaimer is available on the About page.

Exploding with info, reading this was a blast, thanks. And question - any views on how Lockheed could benefit or suffer from increased European defense spending? Defense companies are booming now Europe. Does this spillover to Lockheed or does it take away? Thanks for any thoughts.