Inside Shift4’s $164.8B Transaction Surge: How This Payment Giant Boosted Revenue by 30%

Spotlight on 90% SaaS Momentum: Explore how subscription-based offerings pushed non-payment revenue to $340.5M in a single year

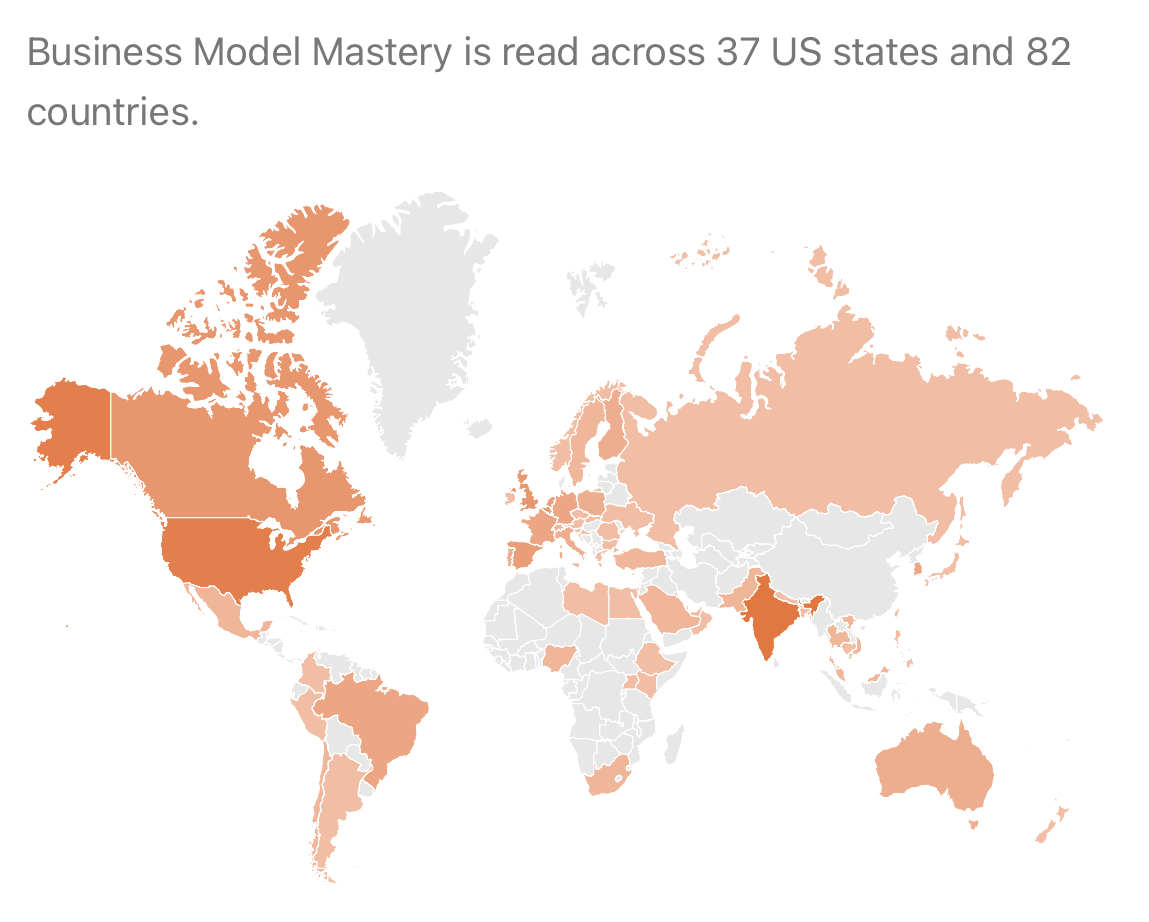

Trusted by 1,800+ private investors worldwide, Business Model Mastery is your daily ritual for building an edge over the market. Each issue breaks down how great businesses truly operate—and what sets them apart by analyzing one company a day, helping you steadily build your own mental database of business models.

I handle the heavy lifting—digging into reports, filings, and key data—so you can focus on recognizing superior business models, comparing opportunities, and outthinking the market.

With 85+ business models analyzed so far, you have a growing library of insights at your fingertips. Each analysis brings you closer to sharpening your edge and building the conviction to invest with clarity and confidence.

If you haven’t yet, lock in the lowest price before rates rise.

Let’s begin.

INTRODUCTION

I want to take you on a journey that reveals how a payment technology company can look small on the outside yet operate like a giant behind the scenes. Imagine handling $164.8 billion in payment volume in a single year. That’s precisely what Shift4 Payments, Inc. achieved in 2024, marking a 51% increase from the year before. You might wonder how that scale is even possible and what hidden forces enable such massive growth. I invite you to keep reading because we’ll explore something that goes far beyond basic transaction fees. We’ll break down where Shift4’s revenue really comes from, how they manage costs so efficiently that their cost per transaction dropped by 11.1% in just one year, and why they’ve set their sights on big enterprise clients and global markets. You’ll learn about both the promise and the pressure of fierce competition, and you’ll see the real numbers behind the company’s progress. By the end, you’ll also have insights into where this industry is headed. Keep these details in mind as we move forward.

I know you’re not just here to skim facts; you’re looking to understand how businesses truly work from the inside. That’s exactly what we’ll do. Picture seeing a company that once focused only on payments suddenly venturing into subscription-based POS solutions and acquiring companies to accelerate growth overseas. Think about how that shift affects everything from market share to profitability. You’ll see how Shift4 stacks up against known players like Square and Adyen, but also giants like Fiserv. Along the way, I’ll share more data about revenues, margins, and expansion that will help you build your own mental map of what makes a payment processor strong or weak. And if you hold on until the end, you’ll discover a broader perspective of why understanding these specific details can sharpen your edge as an investor.

SECTION 1: THE PATH TO REVENUE

I want to start by showing you exactly where Shift4’s money comes from. A lot of people think of payment processing as just swiping a card and letting a small fee trickle in, but in Shift4’s case, there’s more at work. The company actually splits its revenue into two main streams: one tied to payments, the other tied to an entire set of technology tools that businesses can use daily.

When we look at 2024, about 89.8% of Shift4’s total revenue came from processing payments. That turned out to be roughly $2,990.1 million, up 25% from the $2,386.0 million they pulled in during 2023. The per-transaction revenue might seem tiny at $0.0203, especially compared to $0.0219 the previous year, but the sheer number of transactions keeps pushing total revenues higher. Lower pricing for big enterprise clients drags the revenue per transaction down, yet the benefit is that these enterprise customers operate with far bigger volumes.

On the cost side, Shift4 has kept expenses in check. In 2024, the cost per transaction dropped to $0.0120, down from $0.0135, thanks to economies of scale and improved processing methods. That left a gross profit per transaction of $0.0083, slightly lower than $0.0084 the year before. The subtle decline doesn’t necessarily point to trouble; it’s part of a deliberate strategy where the company welcomes large customers, accepts a lower fee, and still grows total gross profit by handling more transactions overall.

But let me shift your attention to something else: the smaller piece of their revenue mix that’s growing incredibly fast. While payments-based revenue is the cornerstone, there’s also what they call Subscription & Other Revenue. This category covers SaaS-based software, point-of-sale (POS) systems like SkyTab, and other business tools. In 2024, this slice of the pie accounted for 10.2% of Shift4’s total revenue, or about $340.5 million, which is 90% higher than the $178.8 million recorded in 2023. Think about that for a moment: a company recognized primarily for processing transactions is rapidly evolving into a technology vendor, providing an entire ecosystem to merchants. This means they’re less dependent on simple transaction fees and can lock in merchants by offering solutions they rely on daily.

In total, Shift4 pulled in $3,330.6 million in 2024, marking a 30% jump from $2,564.8 million the year before. The bulk of that revenue still comes from payments, but the technology component is becoming a bigger part of the story. Part of their revenue also depends on geography. While 83.2% of 2024 revenue came from the U.S., bringing in $2,770.7 million, the most explosive growth happened internationally, where revenues hit $559.9 million, up a staggering 454%from the prior year. A key driver was the acquisition of Finaro, which opened new markets in Europe, along with strategic partnerships in both Europe and Latin America.

I think it’s important for you to see how these pieces reinforce each other. Larger enterprise clients bring higher volume, lowering cost per transaction. Meanwhile, advanced software solutions increase loyalty and bring in recurring subscription revenue. The net effect is a business that’s not just chasing transaction after transaction but building long-term relationships with major merchants.

SECTION 2: DISTINCTION FROM OTHERS

Now let’s explore the payment processing arena in greater detail. If you follow this industry, you know it’s crowded and competitive. Giants like Fiserv (with a 15.1% share) and Global Payments (with a 13.2% share) handle enormous volumes, while disruptors such as Adyen (taking 10.3%), and Square (with 8.5%) also make a strong showing. Shift4 itself holds around 5.8%—not the largest slice, but a slice that’s been growing.

You might wonder how Shift4 can keep expanding when far bigger companies also want these merchants. The answer lies in a combination of technology integration, secure architecture, and global reach that appeals, in particular, to enterprise clients. Think about hospitality chains, large retail brands, or nationwide restaurant franchises. Such businesses crave a single system that handles in-store payments, online orders, subscription services, and analytics in one platform.

I want you to pay special attention to the way Shift4 bundles its solutions. While some competitors focus on providing straightforward payment processing, Shift4 goes deeper. They offer an all-in-one package that includes their SkyTab POS, mobile solutions, and enterprise analytics tools. This integrated approach removes much of the complexity merchants typically face when they have to piece together separate platforms for payments and subscription-based software. By packaging everything under one umbrella, Shift4 keeps its merchants more dependent on its solutions. That dependence makes it tougher for a business to switch to a competing processor, which can sustain Shift4’s revenue even if new competitors undercut them on price.

Another strength stems from the company’s omnichannel capabilities. They let clients accept payments in-store, online, and through mobile devices, all synced into one system. Square also covers multiple payment channels, but Square often focuses on smaller merchants. Shift4’s sweet spot is higher-volume restaurants, hospitality brands, and enterprise retailers. That might not sound like the flashy sector of tech startups, but the volumes are huge. And in payments, volume is everything.

You’re probably aware that global expansion can amplify both revenues and compliance headaches. Shift4’s move outside the U.S. triggered a massive revenue jump of 454% in international markets. But each new region brings a new set of rules, from the EU’s PSD2 to local tax codes. Still, Shift4 sees this expansion as essential. They don’t want to stay limited to the U.S. while competitors like Adyen dominate international transactions. By acquiring companies like Finaro and Vectron, Shift4 not only adds new customers but also gains the regional expertise needed to navigate varied compliance landscapes.

I also want to point out the security and fraud-prevention side. Because of advanced tokenization and encryption methods, Shift4 can protect merchants against costly breaches. One of their marketing hooks is that they reduce merchants’ liabilities. This isn’t just a technical perk; it’s a crucial selling point, especially for enterprise brands that have to safeguard millions of card transactions.

Is everything perfect? Certainly not. Shift4 faces price pressure from agile competitors that can offer discounts or specialized software in new niches. They must also keep an eye on fintech startups experimenting with cryptocurrency transactions or alternative payment channels. Regulatory changes could demand new compliance layers. Yet, when you look at Shift4’s day-to-day operations, it’s clear they’ve chosen to compete on more than just price, and that is often the difference between a short-lived vendor and a long-term partner in the payment world.

CONCLUSION

At this point, I hope you see why I believe Shift4 stands out. They haven’t settled for merely collecting fees on each transaction. Instead, they’ve layered on so many extra services—like robust POS systems, targeted SaaS offerings, and strong enterprise-level security features—that merchants find them indispensable. That approach has enabled them to grow total revenue by 30% in a single year, from $2,564.8 million to $3,330.6 million, while reducing the cost for every transaction they handle. On top of that, they processed $164.8 billion in payment volume in 2024, a remarkable jump of 51% from the previous year. Even though revenue per transaction dipped, the sheer scale of new large clients balanced the equation.

You’ve also seen how a smaller market share of 5.8% can be deceptive when it’s positioned in the right markets. Shift4 is going after enterprise clients that demand advanced solutions and are less likely to swap providers on a whim. They’ve also seen subscription and other revenues skyrocket by 90%—that’s not a random spike; it’s a sign that they are evolving into a more complete technology solutions partner for merchants. And let’s not forget how aggressively they’ve expanded outside the United States, grabbing a 454% boost in international revenue.

You and I both know the best investing decisions aren’t made by chasing hype or guesswork; they’re formed by looking under the hood at how a business truly operates. Today, you’ve done exactly that. You’ve uncovered the inner mechanics that make Shift4 more than just a payment processor. You’ve seen how integrated solutions, global acquisitions, and enterprise-focused technology can build a moat in a highly crowded industry.

I want you to recognize that every piece of knowledge you gain compounds over time, adding layers of depth to your understanding of businesses and markets. Each time you dive into a company’s strategy, analyze its costs, or examine its long-term positioning, you become sharper and more confident. Keep expanding that mental database. The more you read, study, and compare, the more you’ll sense patterns and red flags that can guide your investment choices. The next time you see a company boasting big transaction numbers, you’ll think about factors like revenue per transaction, cost per transaction, subscription add-ons, and international reach.

I’m convinced that honing your ability to see the entire picture—revenue streams, unit economics, and competitive pressures—puts you in a position of strength. Deep understanding leads to better judgment, and better judgment often leads to wiser investments. Thank you for joining me in exploring Shift4’s inner workings. If you keep building on this foundation day after day, you’ll become the sort of investor who doesn’t just follow the headlines but anticipates them, acting with clarity and conviction. That’s the edge we’re all looking for, and I’m excited to keep uncovering these truths with you as you grow your knowledge, piece by piece.

Let’s keep sharpening your edge, one business model at a time.

See you tomorrow.

⏰✋🏼 P.S: Before you go, I have a few important messages to share with you. 👇🏻

Getting value from Business Model Mastery? Hit LIKE (❤️)—it’s how you shape what comes next.

Every issue breaks down how great businesses really work—exposing hidden revenue streams, competitive advantages, and the factors that keep them ahead. I do the deep research so you can spot opportunities before the market catches on.

But here’s the deal: Liking this isn’t just appreciation—it’s a signal. It tells me what’s resonating, what to double down on, and which insights sharpen your edge the most.

If this helped you see smarter, think sharper, and invest better, hit LIKE now—so I know to bring you more of it.

🚨⏰Discover the Hidden Mechanics Behind Every Great Company

Have you ever felt unsure about what really powers a business? Many people skim headlines or trust rumors, but never learn the deeper forces that drive a company’s success. Business Model Mastery changes all of that by delivering concise, daily insights that show exactly how high-performing organizations generate revenue, manage their core operations, and stay ahead of the game—even under pressure.

Every day, you’ll receive a new look at a specific company’s engine: how it actually earns money, what expenses matter most, and why certain strategies work when others fail. Over time, these daily briefs form an expanding library of real-world examples—giving you a permanent resource you can revisit any time you want. You’ll be able to compare different models, connect key ideas, and spot subtle patterns that most people never see.

How It Works

1. Daily Breakdowns

Each email focuses on one company’s blueprint for making money. You’ll see the core elements that set it apart, plus the critical details that can make or break its future.

2. Always-Growing Library

As you collect each breakdown, you build a personal archive of business strategies. Whether you want to explore tech giants, retail innovators, or emerging industry players, you can always return to earlier entries to compare different approaches. This knowledge compounds like interest, growing more powerful with each new installment.

3. Behind-the-Scenes Data and Advanced Insights

Go beyond the surface. You’ll learn about cost structures, market positioning, and tactical decisions that fuel long-term success. You’ll recognize patterns in how companies defend themselves against rivals and expand their influence over time.

4. Clarity That Lasts

This skill set doesn’t fade away. No market swing or corporate trend can erase what you’ve learned. It stays with you, sharpening your perspective on any future opportunity.

Why This Matters

Many investors jump from one idea to another, never truly learning how a business works at its core. Some rely on hype, while others gamble on guesswork. In contrast, this daily approach aims to give you genuine clarity about how companies thrive—or collapse—under real-world conditions. Each new insight builds on the last, making your overall understanding richer and more complete with every passing day.

Instead of feeling stuck or uncertain, you’ll approach new opportunities with a firm grasp of what truly powers a company. You’ll see how products, services, and competitive positions interlock to create a lasting edge. This solid grounding gives you the kind of confidence that sets you apart. It’s the difference between following trends and knowing how businesses actually succeed.

What You Gain

• Unique Knowledge: Most people never look beyond flashy headlines. You’ll develop an awareness of core principles that often go unnoticed, even by experienced market watchers.

• Permanent Skills: No matter how the economy shifts, you’ll continue to benefit from what you’ve learned—year after year.

• A Clear Way to Compare Companies: When you read about a new venture, you’ll draw on existing insights to see whether it measures up to proven models you’ve already studied.

• Confidence to Explore: Day by day, your perspective widens. You’ll notice nuances and warning signs that remain invisible to others. That deeper level of certainty helps you move forward in a way that feels natural and informed.

✅ Your Special Rate: $277/Year (Over 40% Off $500)

For a limited time, you can lock in a forever rate of $277/year—securing a more than 40% discount from the regular $500/year. Once you join, you keep that lower rate as long as you remain subscribed, no matter how high the price climbs for new members.

⏰ Deadline: Sunday, March 9th

After this date, the rate reverts to at least $500/year, and anyone who misses out will have to pay more. If you act now, you secure the discounted price permanently, ensuring you’ll continue to receive daily deep dives and access to the ever-growing collection of archived business models.

Why Act Before March 9th?

• Lifetime Discount: Joining now locks in the $277/year rate forever, preventing future price increases for you.

• Rapidly Building Knowledge: Every day you wait is another day without fresh insights that could broaden how you evaluate any company.

• Exclusive Resource: This library isn’t just a quick read; it’s a lasting catalog of proven models, each with its own unique lessons.

• Distinct Perspective: As you learn how different businesses truly operate, you’ll stand out from those who rely on secondhand chatter. You’ll have a sharp, firsthand view of what really drives success.

Imagine the Difference

After a few weeks, you’ll have gone deep into multiple companies, revealing the strategic choices they make and the reasons they excel or stumble. Over months, you’ll build a robust set of examples you can draw upon whenever you assess a new idea or potential opportunity. This steady accumulation of knowledge is the kind of advantage that few people ever achieve. Others may still be guessing; meanwhile, you’ll understand the underlying mechanisms that point to sustainable growth.

No one can take this new way of thinking away from you. Once you see how actual business engines work, you can’t unsee it. Your perspective changes permanently, and you’ll evaluate future ventures through a more informed lens. It’s a shift that feels natural and empowering, leading to decisions based on clarity instead of hearsay.

⏰ Claim Your Spot at $277/Year Now

Don’t wait until the rate goes back up to $500—or even higher. By securing your spot before Sunday March 9th, you guarantee yourself a permanent discount and daily access to the real stories behind how companies function. It’s an ongoing process that delivers value every single day, adding up to a level of expertise that sets you apart.

Click below to lock in your membership at $277/year. You’ll begin receiving concise, behind-the-scenes breakdowns that reveal crucial details most people never learn. Day by day, your knowledge grows—building an enduring advantage that helps you see opportunities and risks more clearly than ever before.

Join now and ensure you always have a reliable resource to guide your understanding of how business really works, from revenue models to hidden costs, from winning strategies to potential red flags. Your seat at $277/year is only guaranteed until Sunday March 9th. Claim it today, and start exploring the proven methods that power some of the world’s most successful companies.

Disclaimer: This content is informational, not financial or professional advice. Investing involves potential loss, and by using this material, you agree to accept all risks and waive class-action rights. Full disclaimer is available on the About page.

You believe this? Smoke and mirrors buddy. Read the card connect llc v. shift 4 case. then tell me if you have the same conclusion.