The Hidden Link Between AI, Pet Care, and Finance: A $1.2 Trillion Opportunity You’re Overlooking

Discover how AI-driven innovation is transforming industries from digital payments to veterinary diagnostics—and why smart investors should pay attention now.

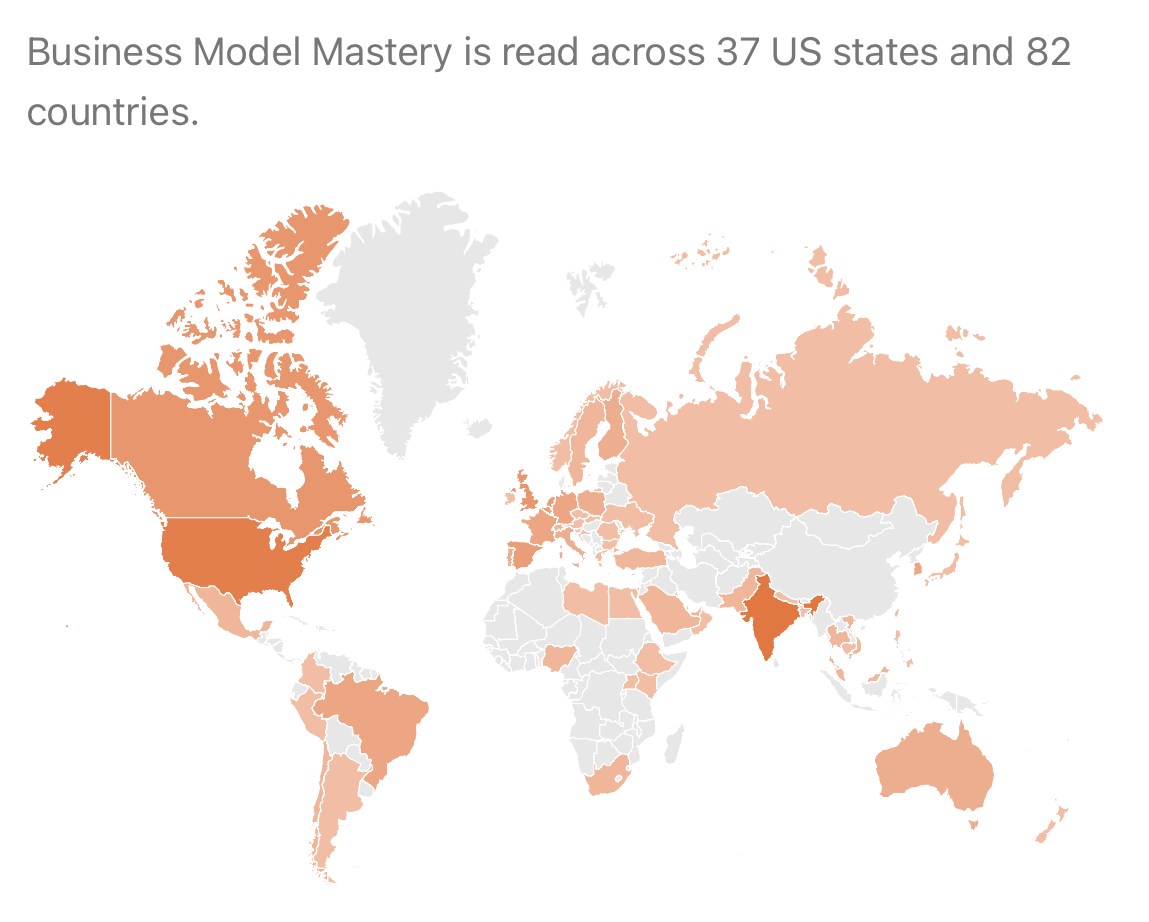

Trusted by 1,700+ private investors worldwide, Business Model Mastery is your daily ritual for building an edge over the market. Each issue breaks down how great businesses truly operate—and what sets them apart by analyzing one company a day, helping you steadily build your own mental database of business models.

I handle the heavy lifting—digging into reports, filings, and key data—so you can focus on recognizing superior business models, comparing opportunities, and outthinking the market.

With 80+ business models analyzed so far, you have a growing library of insights at your fingertips. Each analysis brings you closer to sharpening your edge and building the conviction to invest with clarity and confidence.

If you haven’t yet, lock in the lowest price before rates rise.

Let’s begin.

I’d love to start this article with a quick survey to hear your thoughts on something a few private investors—who read this newsletter just like you—have brought up.

Some readers feel that a daily publishing schedule might be a bit too much, making it harder to absorb all the insights. They’ve suggested shifting to three emails per week instead, to make the content easier to digest and apply.

Since this newsletter is for you, I want to make sure it’s as valuable and effective as possible. So, I’d really appreciate your input! I’ve put together a short survey to get your thoughts, and your feedback will help me decide the best schedule moving forward.

I’d especially love to hear from those of you who have already pledged for this newsletter—and there are many of you!Your support means a lot, and your feedback is crucial in shaping how I deliver the content you’ve invested in. If you have a moment, please take the survey and let me know what you think!

Chapter 1: The 10 Megatrends That Will Shape Investing for the Next Decade

In the coming years, powerful global trends will reshape how we invest, shop, and live. At the forefront are artificial intelligence (AI) and cloud computing, which are accelerating innovation across every sector. AI revenue is projected to skyrocket from around $136 billion in 2022 to nearly $1.2 trillion by 2030, driven by breakthroughs in machine learning, natural language processing, and big data analytics. Similarly, cloud computing spending could exceed $1 trillion by the end of the decade, up from $490 billion in 2022.

Fintech is undergoing a massive transformation as well. Digital wallet usage could reach 60% of the global population by 2030, a significant leap from 30–35% in 2022. In China, mobile payment adoption already exceeds 80% of smartphone users, while over 50% of Gen Z in the U.S. now regularly use mobile payments. Advanced AI-powered fraud detection tools are also revolutionizing transaction security, saving businesses billions annually.

Healthcare and biotech are equally poised for explosive growth. The global biotech market is expected to hit $2.5 trillion by 2030, fueled by gene editing, mRNA research, and AI-driven drug discovery. As populations age—one in six people will be over 65 by 2050—the demand for personalized treatments and robotic surgeries will increase dramatically. Leading pharma companies are committing 15–20% of their revenues to research and development.

E-commerce continues to surge, with sales expected to surpass $8 trillion by 2026, up from $5.2 trillion in 2022. The shift toward ultra-fast shipping and AI-powered product recommendations is driving higher purchase frequencies and average order sizes. Meanwhile, the luxury goods sector is projected to reach $1.7 trillion by 2026, with Asia-Pacific markets contributing around 70% of this growth.

In entertainment, streaming platforms have amassed over 1.5 billion monthly users globally, generating more than $100 billion in revenue annually. The gaming industry, valued at over $200 billion, is growing by 8–10% each year, powered by trends like eSports, mobile gaming, and cloud-based platforms.

The mobility sector is also evolving rapidly, with electric vehicles (EVs) expected to account for up to 40% of global car sales by 2030. At the same time, private equity and venture capital markets could surpass $14 trillion in assets by 2027, as investors seek higher returns outside traditional markets.

These megatrends reveal a common thread: the rise of data-driven ecosystems, a shift toward emerging markets, and the growing importance of personalized digital experiences across industries.

You can go deeper here 👇🏻

Chapter 2: Deep Dive – American Express vs. Visa & Mastercard

When it comes to payment giants, American Express (Amex) operates on a distinctly different model compared to Visaand Mastercard. Amex uses a closed-loop system, managing every aspect of transactions from card issuance to processing. This structure allows Amex to charge merchants higher fees—2.3–3.5%—but in return, it serves a more affluent client base, often generating over $40 billion in annual revenue through fees, interest, and premium services.

In contrast, Visa and Mastercard function through open-loop networks. They do not issue cards directly; instead, banks handle that responsibility and absorb credit risk. These companies primarily focus on processing payments, a strategy that delivers incredibly high profit margins—often exceeding 50%. The scale of their operations is immense: Visa handles over $10–11 trillion in payments annually, while Mastercard processes between $6–7 trillion. Amex, despite its premium focus, manages around $1.3–1.5 trillion.

One of the key differences lies in merchant acceptance. While Visa and Mastercard are accepted by 70–80 million merchants worldwide, Amex has a smaller network of about 30 million, though its focus on wealthier customers often results in higher transaction values.

Ultimately, Amex’s strategy emphasizes exclusivity and premium service, whereas Visa and Mastercard prioritize global scale and efficiency—two fundamentally different approaches that reflect broader trends in the financial services landscape.

You can go deeper here 👇🏻

Chapter 3: Inside the Pet Industry

The pet industry has undergone a radical transformation in recent years, driven by the humanization of pets. An overwhelming 95% of U.S. pet owners consider their pets as family members, which has fueled rapid growth in premium healthcare offerings. The global market for companion animal healthcare could reach $34 billion by 2027, with a 9.5% compound annual growth rate (CAGR).

One notable area of expansion is advanced veterinary treatments. Zoetis, a leading player in animal health, saw a 97% increase in global revenue for its osteoarthritis medications, Librela and Solensia. This signals a rising demand for specialized treatments, particularly for conditions that affect a significant portion of the pet population—nearly 40% of dogs suffer from osteoarthritis but often go untreated.

Diagnostics and preventive care are becoming central to pet healthcare. Companies like IDEXX have experienced 7% organic growth in their companion animal diagnostics segment. The market for veterinary diagnostics could grow at a 9.6% CAGR, reaching nearly $8.9 billion by 2027.

E-commerce is also reshaping the industry. Zoetis’s Simparica Trio—a popular parasite-prevention treatment—now derives 20% of its U.S. sales from retail, marking a significant shift toward online purchasing. International markets are driving further growth: IDEXX reported 10% revenue growth in Europe and China, while Zoetis achieved 13% operational growth outside the U.S.

Sustainability efforts are also on the rise, particularly in the livestock segment, which could expand at an 8.3% CAGR to reach $40 billion by 2026. This growth reflects increasing interest in eco-friendly vaccines and more sustainable veterinary practices.

You can go deeper here 👇🏻

Chapter 4: Why Software Companies Look Less Profitable Than They Really Are

Software companies often appear less profitable than they truly are—a misleading impression caused by accounting practices that categorize research and development (R&D) as an expense. Spending on coding, product upgrades, and feature development is listed as operating expenditure (OpEx), reducing short-term profits even when these investments fuel long-term growth.

The value of intangible assets—such as patents, code, and intellectual property—also remains understated on traditional balance sheets. Yet, many software firms operate with extraordinarily high gross margins, often ranging between 70% and 90%. Once developed, software can be distributed at virtually no extra cost, creating an extremely scalable business model.

Another factor that obscures true profitability is the reinvestment of cash flow. Software companies often funnel substantial resources back into growth—expanding product offerings, entering new markets, or acquiring customers. While this reduces free cash flow in the short term, it positions businesses for accelerated expansion and market dominance over time.

For investors, standard valuation metrics like price-to-earnings (P/E) or price-to-book can be misleading for software firms. Instead, focusing on non-GAAP earnings or adjusted free cash flow offers a clearer picture of these companies’ long-term financial health.

You can go deeper here 👇🏻

Conclusion – Connecting the Threads

Across these diverse industries—whether in payments, biotech, pet healthcare, or software development—the same underlying forces are at play: data-driven innovation, technological transformation, and a growing focus on personalization.

The financial sector demonstrates this dynamic clearly. American Express leans on exclusivity and high-spending clients, while Visa and Mastercard harness global scale and efficiency. Similarly, in pet healthcare, companies like Zoetisare targeting premium market segments with high-end treatments, reflecting the growing willingness of consumers to invest more in their pets’ well-being.

Software companies and biotech firms share a common narrative: significant investments in R&D often mask the true value these businesses generate over time. The hidden potential of these industries becomes clearer when we look beyond conventional accounting frameworks.

Emerging markets are also driving much of this transformation. In digital payments, pet care, and software, countries like China, India, and regions in Latin America are leading adoption rates, offering companies new opportunities for growth.

The overarching message is clear: industries that effectively leverage data, technology, and consumer-centric strategies will be best positioned to thrive in the coming decade. As the lines between tech, finance, and healthcare blur, the most successful businesses will be those that understand how innovation, personalization, and global expansion intersect.

For investors, entrepreneurs, and decision-makers, recognizing where hidden value lies—and how rapid innovation can disguise long-term profitability—will be the key to staying ahead in this rapidly evolving global economy.

Let’s keep sharpening your edge, one business model at a time.

See you tomorrow.

✋🏼 P.S: Before you go, I have a few important messages to share with you. 👇🏻

Getting value from Business Model Mastery? Hit LIKE (❤️) to shape what comes next.

Each issue breaks down how great businesses really work—revealing revenue streams, competitive advantages, and the factors that keep them ahead. I handle the deep research so you can focus on spotting opportunities before the market catches on.

But here’s the key: when you click LIKE, you’re not just showing appreciation—you’re shaping the future of this newsletter. Your feedback tells me exactly what insights you want more of, helping me deliver content that sharpens your edge.

If this helps you think smarter and invest better, hit LIKE now to influence what comes next.

✍️ 🏆 Share Your Insight and Win a Special Prize

I’d love to hear from you. What’s the most valuable insight you’ve gained from this article—or from any of my past writings? More importantly, how has it shifted your perspective? Maybe it’s changed the way you approach investments or helped you spot hidden opportunities in a niche industry you hadn’t appreciated before.

Your feedback matters—it helps me refine the content and deliver even more value. You can share your thoughts with me directly via private message or post them as a comment on the article. To make it even more exciting, the most thoughtful and detailed response will win a special prize. I look forward to hearing your insights.

⏳ Your Limited-Time Offer

Right now, you can lock in a forever rate of $277/year—a permanent 40%+ discount from the regular $500/year. This is the lowest price you’ll ever see, and with only 10 spots originally available, just a few remain. Once they’re gone, the price rises—regardless of the deadline on Sunday, March 9th at 11:59 PM (California time). This isn’t just about saving money—it’s about securing a lasting edge. For less than a coffee a day, you’ll gain daily insights that break down how great businesses truly operate, analyzing one company at a time to help you steadily build a mental database of business models. I handle the heavy lifting—digging into reports, filings, and key data—so you can focus on recognizing superior business models, comparing opportunities, and outthinking the market.

Payments are processed securely through Stripe, and your card won’t be charged until the subscription reaches $500/year—letting you lock in today’s discounted rate risk-free. While all past content is still free, it will soon become exclusive to paying subscribers. Subscribing now secures uninterrupted access at the lowest possible rate, one that will never return. This isn’t just a financial decision—it’s an investment in sharpening your thinking, understanding what sets winning businesses apart, and building a competitive edge that keeps you ahead of the market. Lock in your forever price today and start mastering business models to outthink—and outperform—the competition.

📣 Share What You Have Learned—And Unlock Exclusive Rewards

If these analyses resonate with you, don’t keep them to yourself—share them with a fellow investor. By doing so, you’re not just helping someone else gain clarity; you’re reinforcing your own understanding through meaningful discussion. The best investors grow together, exchanging insights and pushing each other to spot opportunities others often overlook.

Now, you can turn that sharing into something even more valuable. Join the Business Model Mastery Referral Program and unlock exclusive, advanced content designed to elevate your investing strategy. Here’s what you can access by referring friends:

• The Beauty Industry Report (5 referrals)– A deep dive into one of the safest and most profitable sectors for private investors.

• Discover Your Unfair Advantage (10 referrals)– Strategies to leverage the unique edge private investors have over large institutions.

• Spotting Network Effects Early (25 referrals)– Learn how to identify one of the most powerful competitive advantages before others even see it.

Plus, the first five participants to hit 25 referrals will receive my personal Company Analysis Checklist—a private tool crafted to save you time, reduce risk, and highlight the most profitable investment opportunities.

Start sharing today, deepen your expertise, and take your investing strategy to the next level. You can find all the information here 👇🏻

🚫 Check Your Spam Folder

Sometimes, emails with images or links end up in Spam or Promotions folders. If you don’t see the latest breakdown, please check there. Mark it as important, so you never miss a valuable insight. A single overlooked email could be the one that saves you from a big mistake or reveals an unexpected winner.

Disclaimer: This content is informational, not financial or professional advice. Investing involves potential loss, and by using this material, you agree to accept all risks and waive class-action rights. Full disclaimer is available on the About page.